Welcome to “Desh ki Taaza Khabar” where we bring you an in-depth analysis of India’s Union Budget 2024-25 presented by the Finance Minister “Nirmala Sitharaman” on 23rd Jul 2024, outlines the government’s roadmap for achieving ‘Viksit Bharat’ (Developed India).

The budget focuses on four major segments of society:

- Women (‘Mahilayen’)

- Poor (‘Garib’)

- Youth (‘Yuva’)

- Farmers (‘Annadata’)

Let’s dive into the detailed breakdown of the budget proposals.

For the full speech, please refer:

https://www.indiabudget.gov.in/doc/Budget_Speech.pdf

Key Highlights:

1. Agriculture and Allied Activities

- Natural Farming: 1 crore farmers will be encouraged to adopt natural farming, with certification and branding support over the next two years. Additionally, 10,000 bio-input resource centers will be established.

- Shrimp Production & Export: NABARD will facilitate financing for shrimp farming, processing, and export.

- Digital Public Infrastructure: Digital crop surveys in 400 districts and issuance of Jan Samarth-based Kisan Credit Cards will be implemented.

- Vegetable Production & Supply Chain: Promotion of Farmer Producer Organizations (FPOs), cooperatives, and startups for the vegetable supply chain.

- High-Yielding Crop Varieties: 109 new varieties of 32 field and horticulture crops will be released.

- National Cooperation Policy: A systematic development plan for the cooperative sector.

- Atmanirbharta in Oilseeds: Focus on increasing production of mustard, groundnut, sesame, soybean, and sunflower.

- Agriculture Research: Comprehensive review to enhance productivity and develop climate-resilient crop varieties.

2. Employment and Skilling

- Working Women Hostels and Creches: Collaboration with industry to increase women’s workforce participation.

- Wage Support: New formal sector entrants will receive one-month wage support in three installments, up to ₹15,000.

- PM’s Package:

- Scheme A: Incentives for first-time employees and employers contributing to EPFO, benefiting 30 lakh youth.

- Scheme B: Job creation incentives in the manufacturing sector.

- Scheme C: Government reimbursement of employer EPFO contributions for new hires, generating 50 lakh jobs.

- Scheme D: Financial support for loans up to ₹10 lakh for higher education, benefiting 25,000 students annually.

- Skilling Program: 20 lakh youth to be skilled over five years, with 1,000 Industrial Training Institutes upgraded.

3. Social Justice and Human Resource Development

- Purvodaya: Development initiatives in Eastern states like Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh.

- Women’s Welfare: Allocation of over ₹3 lakh crore for schemes benefiting women and girls.

- Tribal Development: Pradhan Mantri Janjatiya Unnat Gram Abhiyan to improve the socio-economic conditions of tribal communities.

- North East Development: Over 100 branches of India Post Payment Bank to be set up.

4. Manufacturing and Services

- Industrial Parks: Development of 12 industrial parks under the National Industrial Corridor Development Programme.

- Internship Opportunities: Internship schemes in 500 top companies for 1 crore youth over five years, with allowances and CSR funds.

- Critical Minerals Mission: Focus on domestic production, recycling, and overseas acquisition of critical minerals.

- Credit Support for MSMEs: Enhanced credit support during stress periods and a new assessment model for MSME credit.

5. Urban Development

- Stamp Duty Reduction: Encouraging states to lower stamp duties for properties purchased by women.

- Street Markets: Development of 100 weekly ‘haats’ or street food hubs in select cities.

- Transit-Oriented Development: Plans for 14 large cities with populations over 30 lakh.

- PM Awas Yojana Urban 2.0: Investment of ₹10 lakh crore to address housing needs of 1 crore urban poor and middle-class families.

6. Energy Security

- Small Modular Reactors: Development of Bharat Small Reactors and R&D in newer nuclear technologies.

- Energy Audit: Investment-grade energy audits in 60 clusters, expanding to 100 clusters.

- Pumped Storage Policy: NTPC and BHEL joint venture to set up a full-scale 800 MW commercial plant.

- Renewable Energy: Initiatives to facilitate the integration of renewable energy into the grid.

7. Infrastructure

- PMGSY Phase IV: All-weather connectivity to 25,000 rural habitations.

- Irrigation and Flood Mitigation: Financial support for projects like the Kosi-Mechi intra-state link.

- Rehabilitation: Assistance for reconstruction in Himachal Pradesh and flood management in Assam, Sikkim, and Uttarakhand.

- National Research Fund: Operationalization of the Anusandhan National Research Fund.

8. Innovation, Research, and Development

- Private Sector-Driven Research: Financing pool of ₹1 lakh crore for private sector-driven research and innovation.

- Space Economy: Setting up a venture capital fund of ₹1,000 crore.

9. Next Generation Reforms

- Land Reforms: Unique Land Parcel Identification Number (Bhu-Aadhaar) for all lands, digitization of cadastral maps, and establishment of land registries.

- Climate Finance: Enhancing capital availability for climate adaptation and mitigation.

- FDI and Overseas Investments: Simplified regulations to facilitate FDIs and use of Indian Rupee for overseas investments.

- New Pension Scheme (NPS): Introduction of NPS Vatsalya and a new solution for existing NPS issues.

10. Tax Proposals

- Income Tax Simplification: Comprehensive review of the Income Tax Act 1961.

- Custom Duty Changes: Reduction and exemption of custom duties on various items to boost domestic manufacturing and exports.

- Direct Tax Proposals: Increased standard deduction for salaried employees and changes in capital gains tax.

- Corporate Tax: Reduction in corporate tax rates for foreign companies and simplification of the tax regime for specific sectors.

Income Tax Proposals

The budget introduces significant changes to the income tax structure, aiming to simplify compliance and provide relief to taxpayers.

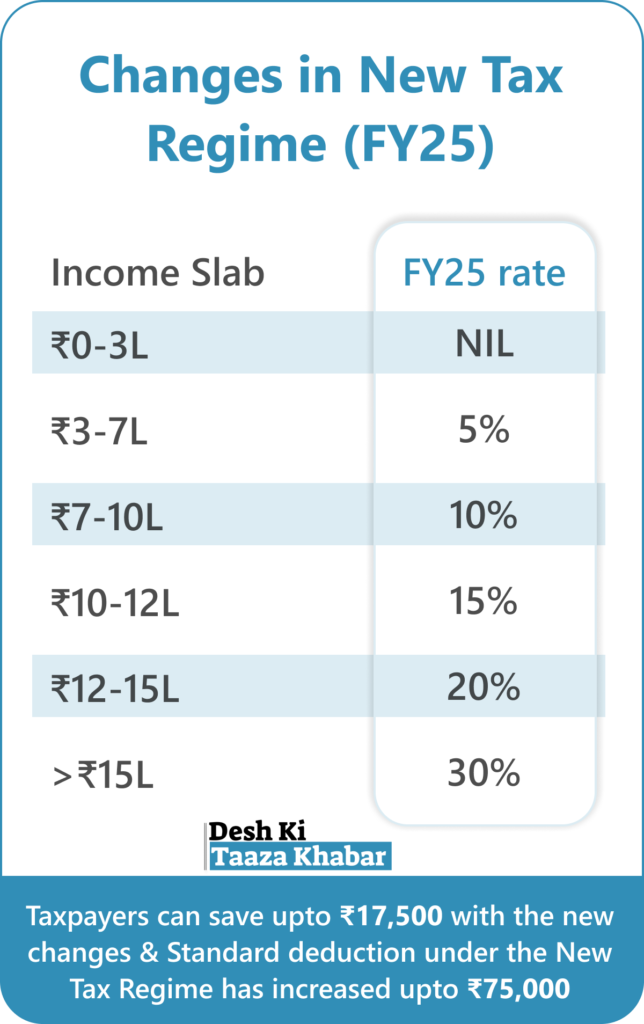

New Tax Regime:

-

- Standard Deduction:

- Increased from ₹50,000 to ₹75,000 for salaried employees.

- Family Pension:

- Deduction increased from ₹15,000 to ₹25,000.

- Capital Gains:

- Short-term gains on financial assets taxed at 20%.

- Long-term gains taxed at 12.5%.

- Exemption limit for capital gains on financial assets raised to ₹1.25 lakh per year.

- Standard Deduction:

Custom Duty Changes

The government has proposed several adjustments in customs duties to boost domestic manufacturing and make essential goods more affordable.

- Mobile Phones and Components:

- Basic Customs Duty (BCD) reduced to 15% on mobile phones, PCBA (Printed Circuit Board Assembly), and chargers, benefiting consumers and promoting domestic manufacturing.

- Precious Metals:

- Custom duty on gold and silver reduced to 6% and on platinum to 6.4%, making jewelry more affordable.

- Marine Exports:

- BCD on shrimp and fish feed reduced to 5%, enhancing the competitiveness of marine exports.

- Solar Panels:

- Exemption on capital goods used in manufacturing solar cells and panels, supporting the renewable energy sector.

- Critical Minerals:

- Fully exempt custom duties on 25 critical minerals, essential for various strategic sectors.

Sectoral Allocations

Each sector has received specific allocations to drive growth and development. Here’s a detailed look at some of the major sectors and their respective budgets:

- Defence:

- Allocation: ₹4,54,773 crore to bolster national security.

- Road Transport and Highways:

- Allocation: ₹2,65,808 crore to enhance infrastructure and connectivity.

- Agriculture and Allied Activities:

- Allocation: ₹1,51,851 crore to support farmers and improve agricultural productivity.

- Education:

- Allocation: ₹1,25,638 crore for improving educational infrastructure and access.

- Healthcare:

- Allocation: ₹89,287 crore to strengthen the healthcare system and improve public health services.

- Rural Development:

- Allocation: ₹68,769 crore to promote rural welfare and development.

- IT and Telecom:

- Allocation: ₹1,16,342 crore to boost digital infrastructure and connectivity.

- Social Welfare:

- Allocation: ₹56,501 crore for various social welfare schemes.

- Commerce and Industry:

- Allocation: ₹47,559 crore to support industrial growth and commerce.

Goods Becoming Cheaper and Expensive

- Cheaper Goods:

-

- Mobile phones and components

- Gold, silver, and platinum

- Shrimp and fish feed

- Solar panels and critical minerals

- Expensive Goods:

-

- Short-term and long-term gains on financial assets due to new tax rates

Conclusion

The Union Budget 2024-25 presents a comprehensive plan to drive economic growth, support various sectors, and provide relief to taxpayers. With significant allocations and strategic tax proposals, the budget aims to pave the way for a prosperous and developed India.

By leveraging these initiatives, India aims to stride confidently towards becoming a ‘Viksit Bharat’ by 2047, marking 100 years of independence.

Stay tuned to “Desh ki Taaza Khabar” for more updates and detailed analyses on the latest news in the country.

This post is a keeper.

Thanks! I’m glad you found it valuable!

I appreciate the thorough analysis you’ve provided in this post. It’s made a big difference in my understanding of the topic.

Thanks for the feedback! I’m glad it helped clarify things for you.